Published: Oct 04,2025

Imagine this:

It’s the end of a sales cycle. Orders are coming in. You’re running ads. Then one morning, your finance team sees something alarming: your bank or payment account is frozen. No notice. No clear reason.

You panic. Refunds, vendor payments, payroll—all get stuck.

Yet you didn’t do anything illegal. You merely accepted payments. But somewhere upstream, illicit money crept in. Regulators or police traced the flow forward and decided your account was part of the chain.

This kind of “guilt by association” freeze is happening more often than you think. For D2C brands—especially younger ones—it’s an existential risk.

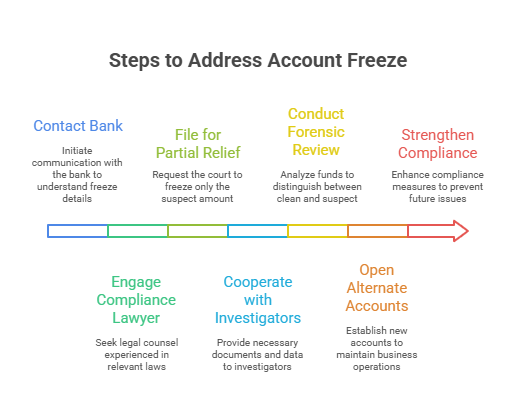

Below, I’ll explain how this happens, show real cases where innocent users got caught in such freezes, recommend controls, and provide a rescue playbook.

Fraudsters like to “layer” money through seemingly legitimate channels. The idea: move stolen or illicit funds through multiple accounts and businesses to obscure the origin.

When law enforcement traces the path, they sometimes freeze downstream accounts (i.e. those receiving the “dirty money”) to prevent further dispersal—even before proving that the recipient was complicit or aware.

So as a D2C brand, you become a target, not because you are doing wrong, but because money flowed through your checkout.

Complicating matters:

Let’s ground this with real cases.

Case A: Kerala Shop Owner — Freeze Because of Upstream UPI Trace

In Kochi, a small poultry shop owner, Navas, found his bank account frozen. The reason? Transactions made to his account by his son-in-law, who had previously transacted with an account under investigation. Even though Navas had no link to the fraud, his account was ordered frozen by cyber police in another state. (The News Minute)

He only discovered the freeze days later—forcing him to mortgage his wife’s jewelry to pay suppliers. Many others across Kerala reported similar sudden freezes when their accounts received small payments linked (somehow) to larger fraud investigations.

This case is a direct analog of what could happen to a D2C brand: you receive payments from customers, some of those payments trace back to upstream fraud, and suddenly your “clean” business gets targeted.

Importantly, the Kerala High Court later ruled that banks should not freeze entire accounts—only amounts alleged to be tainted.(The News Minute)

Case B: Chennai Woman — Rs.150 Mystery Deposit Causes Full Freeze

In Chennai, an office assistant named Santhana Selvi received an unexpected deposit of Rs.150 into her bank account—money she thought was tied to some minor online engagement. (TOI Report)

This small deposit turned out to be routed from a cyber fraud ring. As a result, authorities froze her entire bank account, locking her out of her savings (nearly Rs.50,000). Even though Rs.150 was the suspect amount, she bore the full brunt.

The freeze disrupted her life—she couldn’t pay her children’s school fees or service debts. When she reached out, police agreed to “mark a lien” on Rs.150 and considered unfreezing the rest; but the process dragged.

These cases illustrate a frightening truth: you don’t need to be complicit in a crime to become collateral damage. Just receiving a small trace amount linked to fraud is enough to risk a full freeze.

The Kerala HC ruling is a positive counterbalance: it demands proportional freezing (only the amount involved) not blanket account seizures.

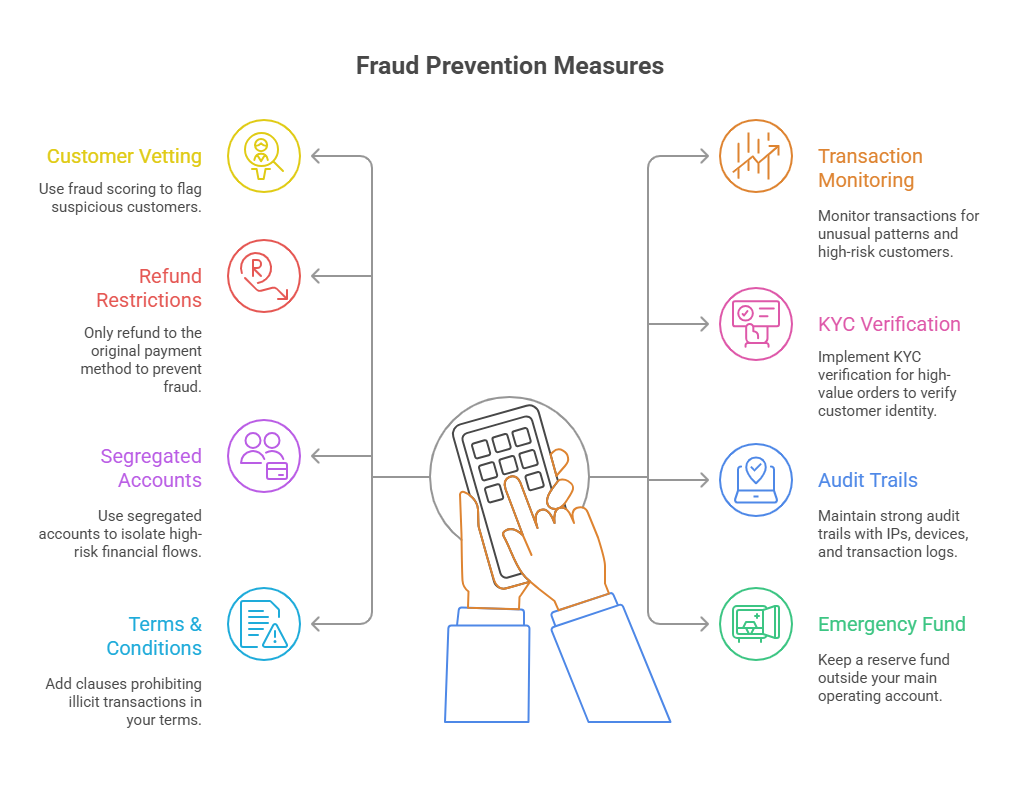

You don’t need to be complicit to have your business dragged into a freeze. The real risk for D2C brands is accepting payment flows without sufficient guardrails.

By weaving in the Kerala and Chennai cases, we see that even tiny amounts can carry massive consequences.

Download the Freeze Survival Checklist PDF , share it with your finance, fraud, and legal teams, and start implementing these controls today.

Written by LYTTY — AI driven Customer Engagement Platform — helping D2C founders not just grow faster, but grow safer.

Download the D2C Bank Account Freeze Survival Checklist (Free PDF) and get practical steps to protect your bank account freezes caused by fraudulent transactions.

Thank You! Your Freeze Survival Checklist is on its way

While you're here, don't stop at prevention - learn how leading D2C brands are using LYTTY to :

Or